charitable gift annuity example

Charitable Gift Annuities An Example. By including NorthShore University HealthSystem in your gift planning you can realize your most aspirational personal and financial goals.

Free Download How To Let Your Donors Know About The New Charitable Gift Annuity Rates

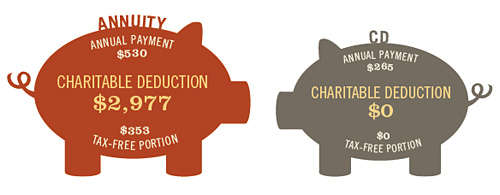

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000.

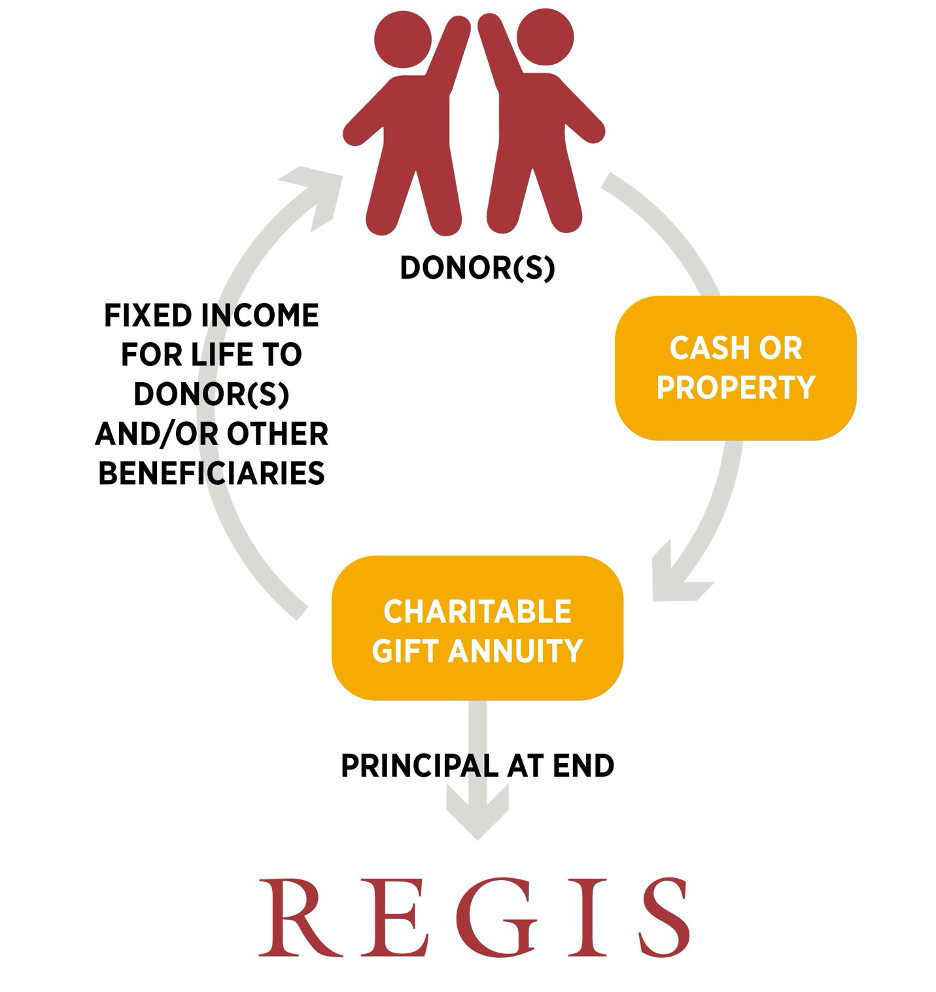

. Charitable Gift Annuities An Example Our donor age 75 plans to donate a maturing 25000 certificate of deposit to AARP Foundation. Charitable Gift Annuities An Example. Because they need continuing income they decide to give the cash in exchange.

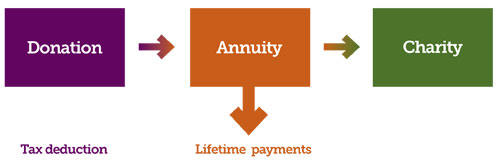

Sample Gift Annuity Disclosure StatementLetter. A graphic illustration of a charitable gift annuity is available. An Example of How It Works.

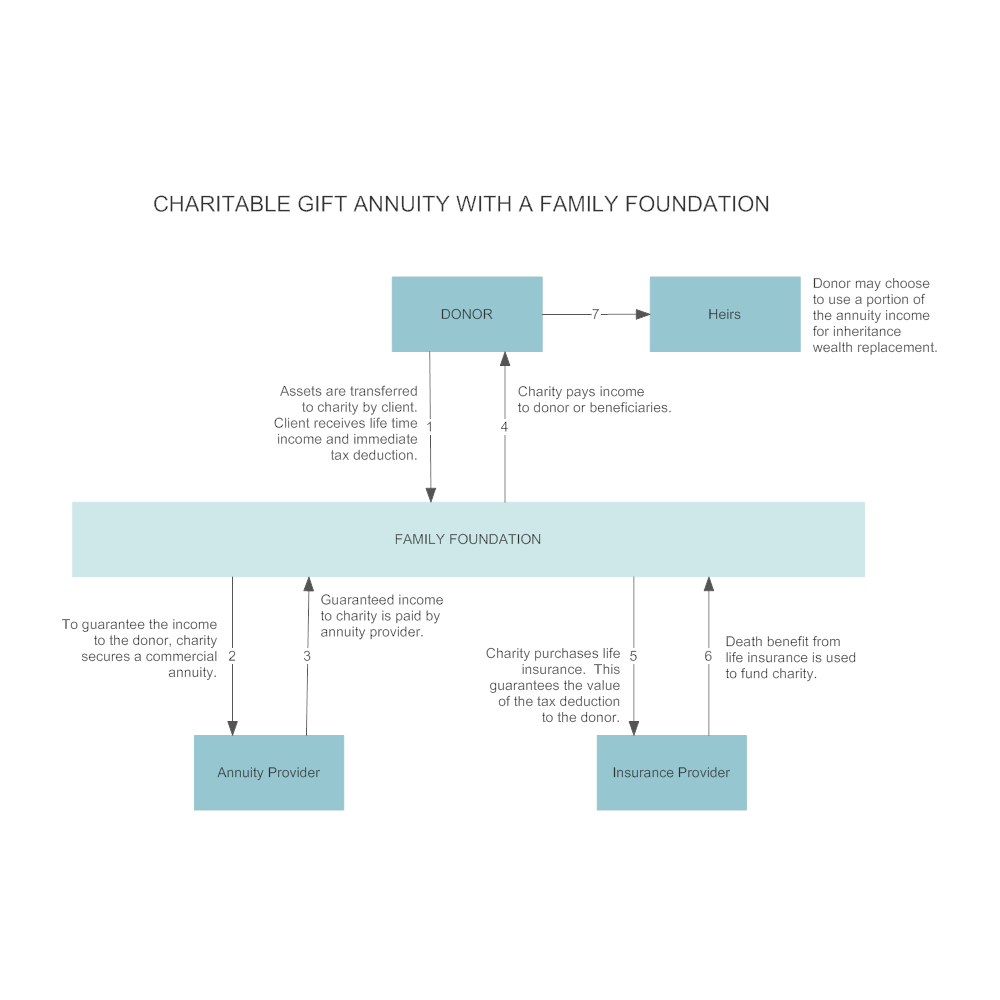

Dennis 75 and Mary 73 want to make a contribution to NPF but they also want to ensure that they have dependable income during their retirement years. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000. State tax liability is.

For example one regulation governing a charitable gift annuity assumes that the money left over after all payment obligations have been satisfied the residuum. Because they need continuing income they decide to give the cash in exchange for a. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to World Wildlife Fund.

Charitable Gift Annuities An Example. 7 rows Susan would like to provide her mother Esther 80 with additional income but knows that her. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000.

Charitable Gift Annuities An Example. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000. Because they need continuing income they decide to give the cash in exchange for.

She has a nest egg of 25000 that she would like to give to Georgetown while also receiving. Because they need continuing income they decide to give the cash in. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000.

With charitable gift annuities you can generally only exclude the part of the capital gain that went to charity. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to Dominican University. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to Feeding America.

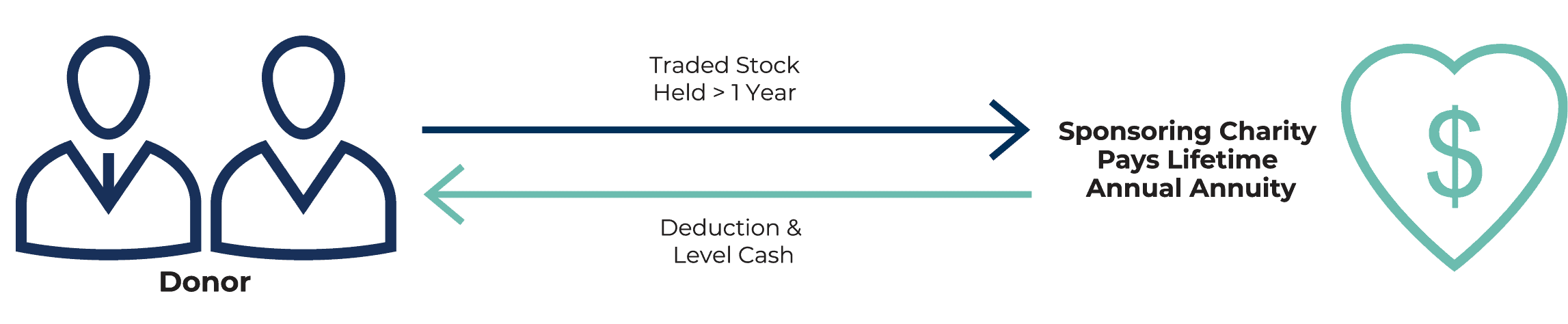

An example of a CGA at Georgetown An alum is looking to secure her finances in retirement. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to the National Park Foundation. A contract that provides the donor a fixed income stream for life in exchange for a sizeable donation to a charity.

An Example of How It Works Dennis 75 and Mary 73 want to make a contribution to Temple University but they also want to ensure that they have dependable income. Charitable Gift Annuities An Example. Partner with us to create the highest standard of.

Example assumes a 34 percent applicable federal rate AFR and a federal income tax bracket of 35. A charitable gift annuity is a contract between a donor and a charity. Charitable Gift Annuities An Example.

Sample Gift Annuity Disclosure StatementLetter. Because they need continuing income they. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000.

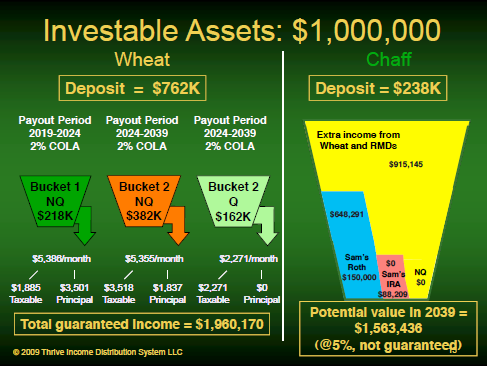

Again youll need to calculate the present value of the annuity income.

Charitable Gift Annuities Development Alumni Relations

Introduction To Charitable Gift Annuities

Emory Magazine Spring 2009 Avoid Risk Cut Taxes With Charitable Gift Annuities

The Weird Math Of Charitable Gift Annuities Retirement Income Journal

Charitable Gift Annuities The Pacific Crest Trail Association

Charitable Gift Annuities Cal Poly

Charitable Gift Annuities Hampshire College

9 Taxation Of Charitable Gift Annuities Part 2 Of 4 Planned Giving Design Center

Annuities The Catholic Foundation

Deferred And Flexible Charitable Gift Annuities American College Of Trust And Estate Counsel Actec Foundation

Charitable Gift Annuities Afsc

Charitable Gift Annuities Wills Eye Foundation

Charitable Gift Annuity Deferred University Of Virginia School Of Law

Charitable Gift Annuities Giving To Stanford

Charitable Gift Annuities Studentreach

Charitable Donation Calculator Infaith Community Foundation

Charitable Gift Annuity Giving To St Lawrence